Getmyoffer.capitalone.com portal is the official web page where people interested in applying for a Capital One credit card can access their application and proceed with it. If you too are in the process of applying for a Capital One credit card, then in this article, we will explain to you how you can utilize the www.getmyoffer.capitalone.com portal for the same.

About Capital One

The Capital One Financial Corporation, or Capital One, is a bank holding company based out of Capital One Tower McLean, Virginia, United States.

Currently, Capital One is one of the largest banks in the US with over 755 branches and about 2,000 ATM counters. The company ranks 99th within the Fortune 500 list and also ranks 9th within the “100 Best Companies to Work For” list by Fortune.

The company was founded back in 1994 and specializes in offering banking services, savings accounts, auto loans, and credit cards.

Capital One credit cards are among the most sought-after credit cards in the United States, especially because of the features and benefits offered by them.

GetmyOffer.CapitalOne.Com

To make the process of applying for a credit card hassle-free, Capital One has launched the www.getmyoffer.capitalone.com portal. In case you had pre-applied for any Capital One credit card or if you received a credit card offer in your email inbox, then you can utilize this portal to proceed further with your application.

What is GetmyOffer.comCapitalOne.Com Reservation Number and Access Code?

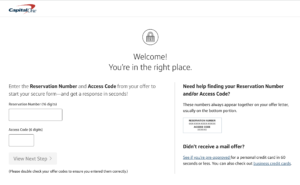

To access the getmyoffer.capitalone.com portal, you first need 2 information: a reservation number and an access code.

In case you applied for a credit card either via phone, email, or website, then the application reference number and access code will be sent to your registered email address.

On the other hand, if you received a mail offer for a Capital One credit card, even then the mail offer contents will have a reservation number and access code in it.

The Capital One application reservation number and access code are unique identifiers that point to each credit card application. So, make sure to enter the correct reservation number and access the web page, and don’t share the details with anyone else to ensure privacy and security.

How to Find the Capital One Reservation Number and Access Code?

The Capital One reservation number and access code will be mentioned under the respective titles within the offer/application email that you received from the company. Usually, both the access code and reservation number will appear together toward the bottom of the email that you received from Capital One.

How to Get Pre-Qualified for Capital One Credit Card?

If you believe you have the prerequisites to apply for a Capital One credit card, then you can apply for a pre-qualification on the same. Below are the steps to follow to apply for Capital One credit card pre-qualify screening.

- Visit the official Capital One Pre-Qualify web page by clicking here.

- You will be asked several questions to access your qualification for a Capital One credit card. The requested information includes your first name, last name, date of birth, SSN, email address, phone number, employment proof, income proof, and bank account details.

- After you provide the answers to the questions, you will be shown a list of credit cards that you are pre-approved for. You can select the best credit card that suits your needs.

- Now, you can submit the final application for the selected credit card by providing a few more details about yourself.

Once you complete step 4, your credit card application will be sent for further verification and approval. Meanwhile, you will receive an email at the address you provided with the Capital One reservation number and access code.

How to Use GetmyOffer.CapitalOne.Com Portal?

Once you applied for a Capital One credit card by following the above steps, or if you received the Capital One credit card offers via email, then you can follow the steps listed below to proceed with utilizing the getmyoffer.capitalone.com portal.

- Visit the www.getmyoffer.capitalone.com portal on your preferred web browser.

- Enter the 16-digit Capital One reservation number and 6-digit Capital One access code in the respective text fields provided.

- Click on the “View Next Step” button.

- Follow the additional on-screen instructions to view and proceed with your Capital One credit card application online.

Once your Capital One credit card application is sent and waiting for approval, then it may take a few days to see the result. Once your credit card application is approved, then further steps will be sent to you via email.

How to Reach Capital One Customer Care?

If you wish to reach out to getmyoffer.capitalone.com customer support team, then you can dial the number 1-877-383-4802 if you are a non-existing customer.

In case you are already a Capital One customer, then you can reach out to the number 1-800-227-4825.

Moreover, if you are requiring assistance regarding credit card fraud, or theft, or lost credit card, then call the Capital One helpline at 1-800-239-7054 or 1-800-427-9428.

Capital One Credit Card FAQ

Below are some of the commonly asked questions about the Capital One credit card along with their answers.

Is Capital One credit card a scam?

As we mentioned in the intro about Capital One, it is one of the biggest and most popular financial institutions in the United States, and lots of people wish to have a Capital One credit card. Thus, Capital One credit cards are in no way a scam.

Is It Guaranteed I’ll Get a Credit Card if I’m Pre-Qualified?

If you receive communication from any bank or credit card issuer stating that you’re pre-qualified or pre-approved for a credit card, then it only means that the issuer has gone through your credit history and scores, and deemed you eligible for a credit card.

However, it is only after you submit the application and they go through an approval process, that final approval is given on your credit card request.

So, basically, pre-qualification or pre-approval does not guarantee you a credit card.

Does Capital One pre-approval affect credit score?

No, Capital One does a soft inquiry when proceeding with the pre-approval of a credit card. Thus, it will not affect your credit score.

Does Capital One approve all credit card requests?

Even though people with low credit scores can get Capital One credit card approvals, the company does not approve all the requests. There are a variety of factors that influence Capital One credit card approval, including income source, monthly/annual income, existing/past debts, etc.